Get ready – I am about to throw around some numbers. But don’t worry, the story that goes with the numbers is one you will want to hear.

The real estate market has been crazy lately. Historically low interest rates have lured enormous numbers of buyers into the hunt for an inadequate number of homes for sale. Even with recent modest increases in rates, loans remain very affordable. Home prices are going up, along with the prices of consumer goods. More Americans than ever before are working, and apparently quite a few of these workers have been hired to make cold calls asking me if I want to sell my house.

But what is really going on, and what can we expect in the near future? Let’s look at some numbers to see what they tell us.*

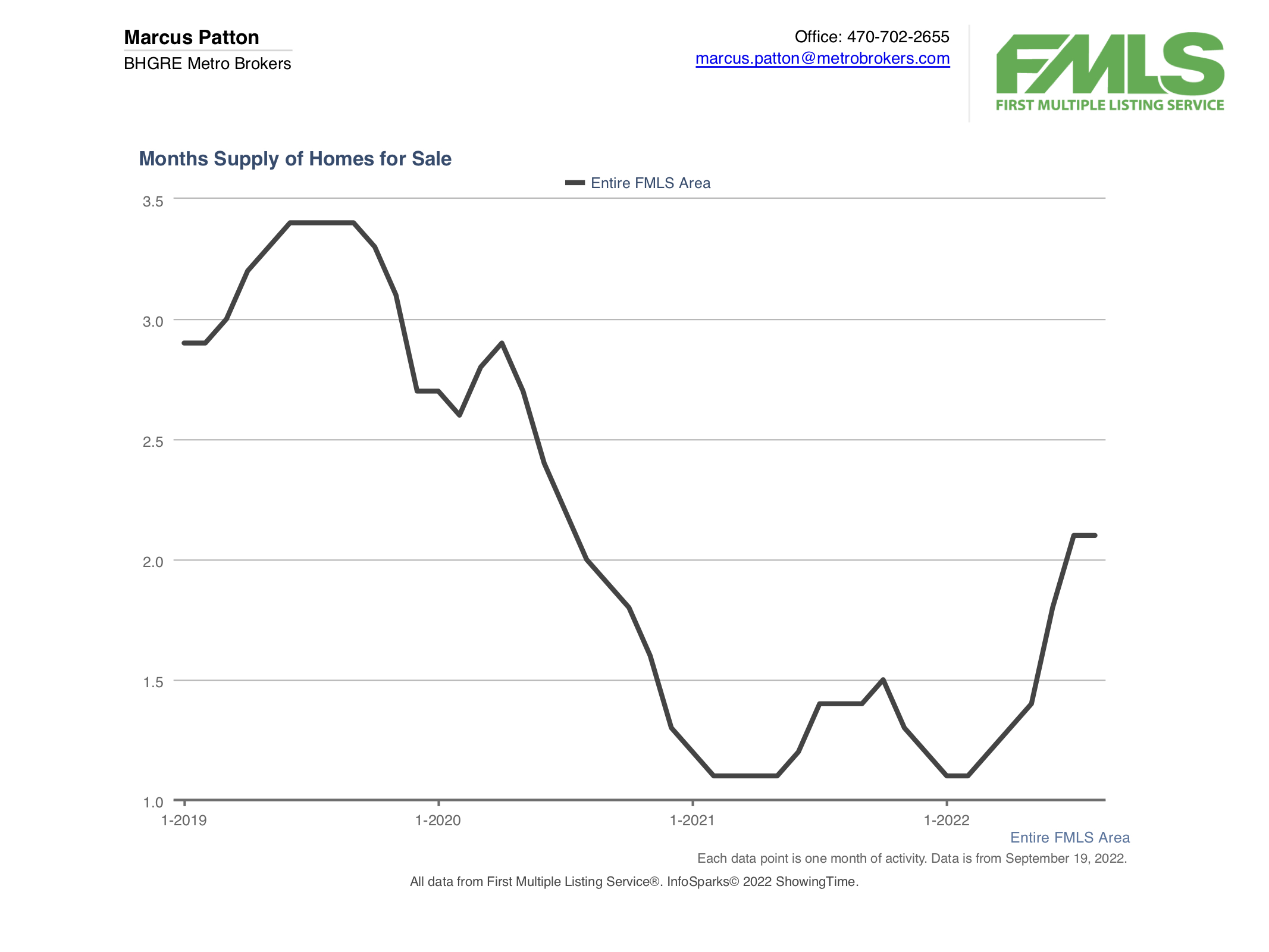

Months of Supply

“Months of supply” is a statistic that gives a picture of the volume of home sales by looking at the relationship between the number of homes on the market and the number of homes that sell in a particular month. For instance, if there are 100 homes for sale, but only 25 homes sold, then there are 4 months of supply on the market.

In an average, balanced real estate market, 4 to 5 months of supply is to be expected. But as everyone knows, we have been in a market that has been far from normal for quite some time. Even before COVID-19 and supply chain problems slowed the construction of new homes to meet our surging demand, we were feeling the lingering impact of the recession of 2008. We are in a seller’s market, and it looks like we will be for the next several years.

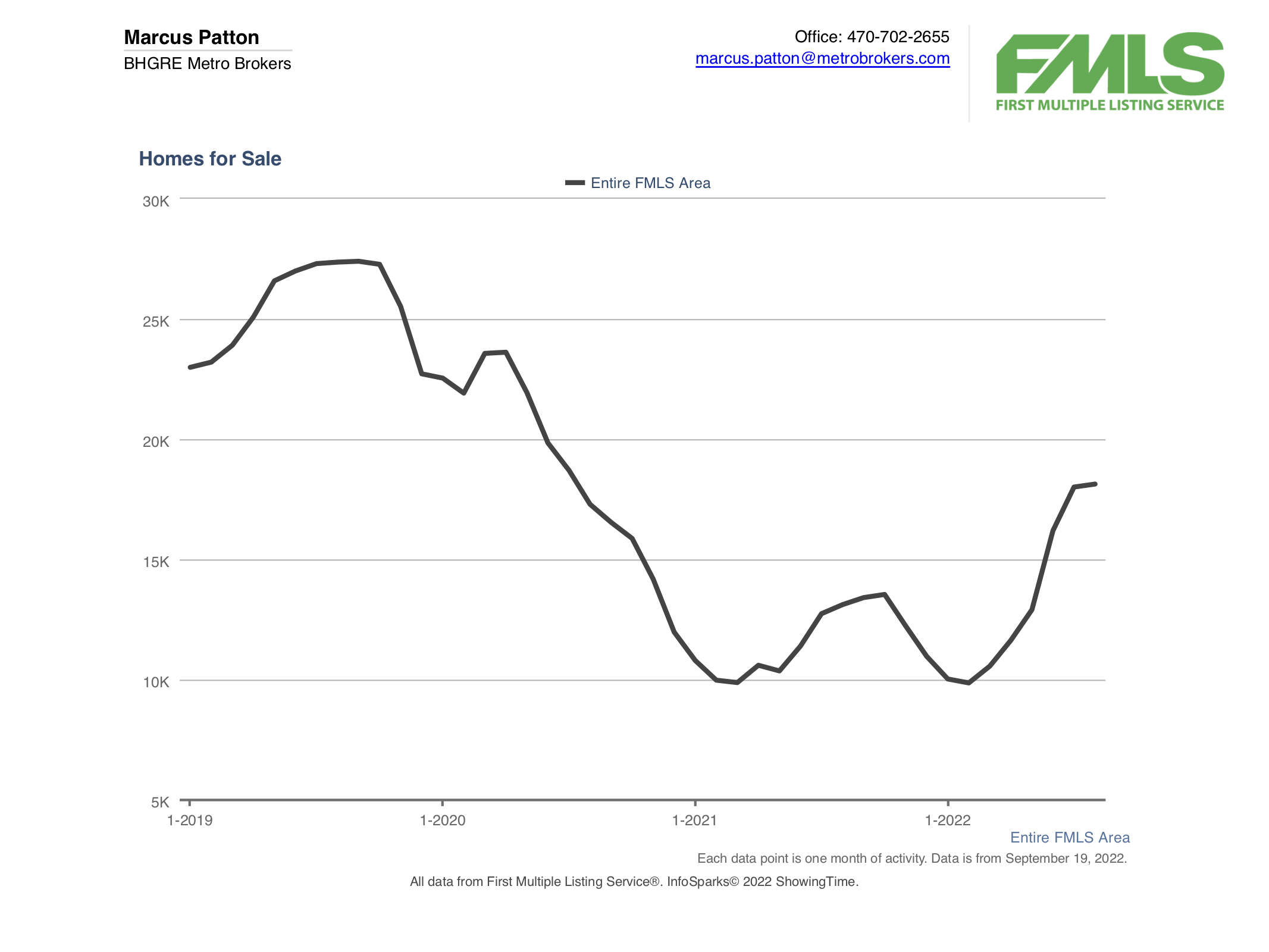

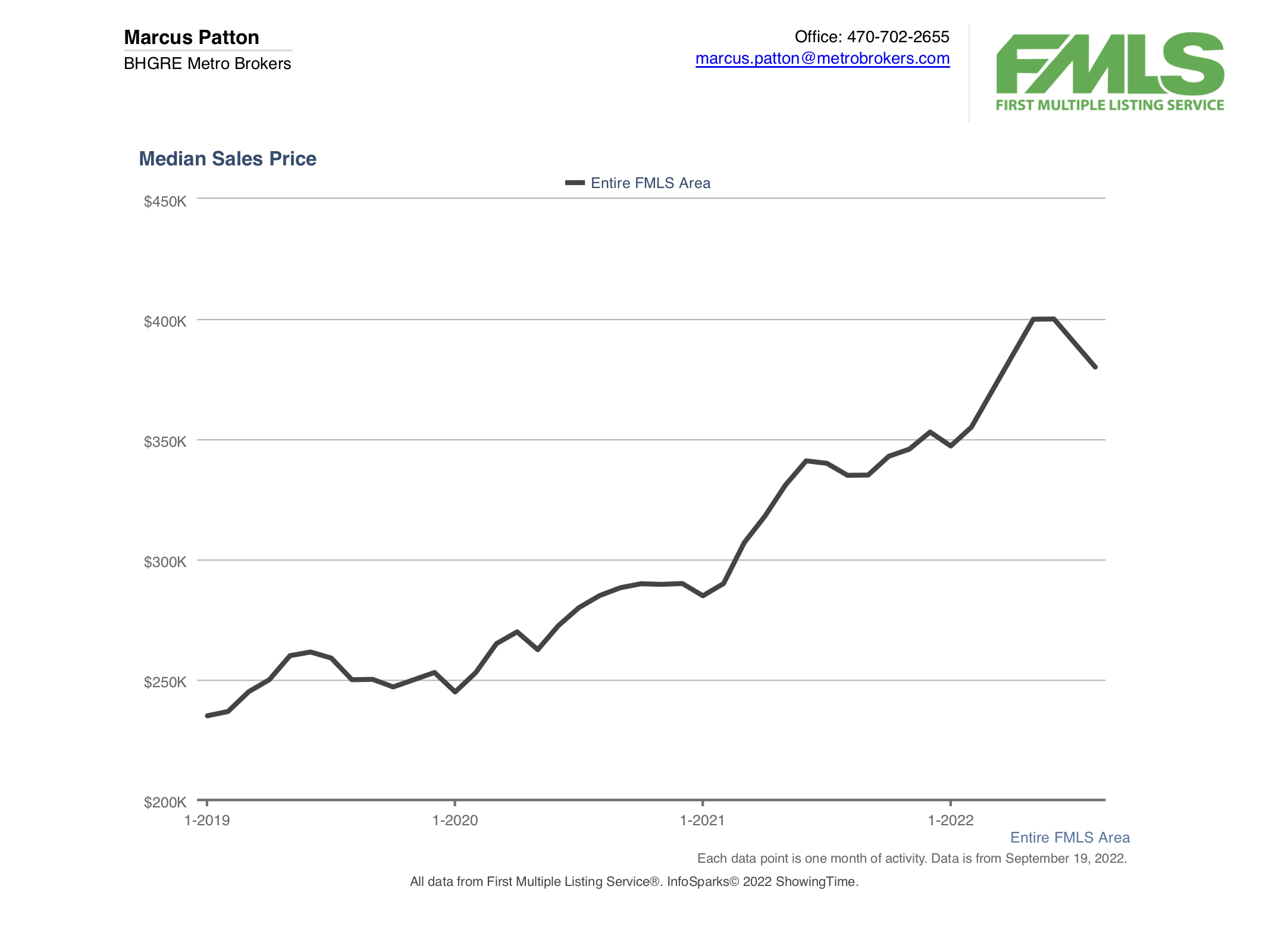

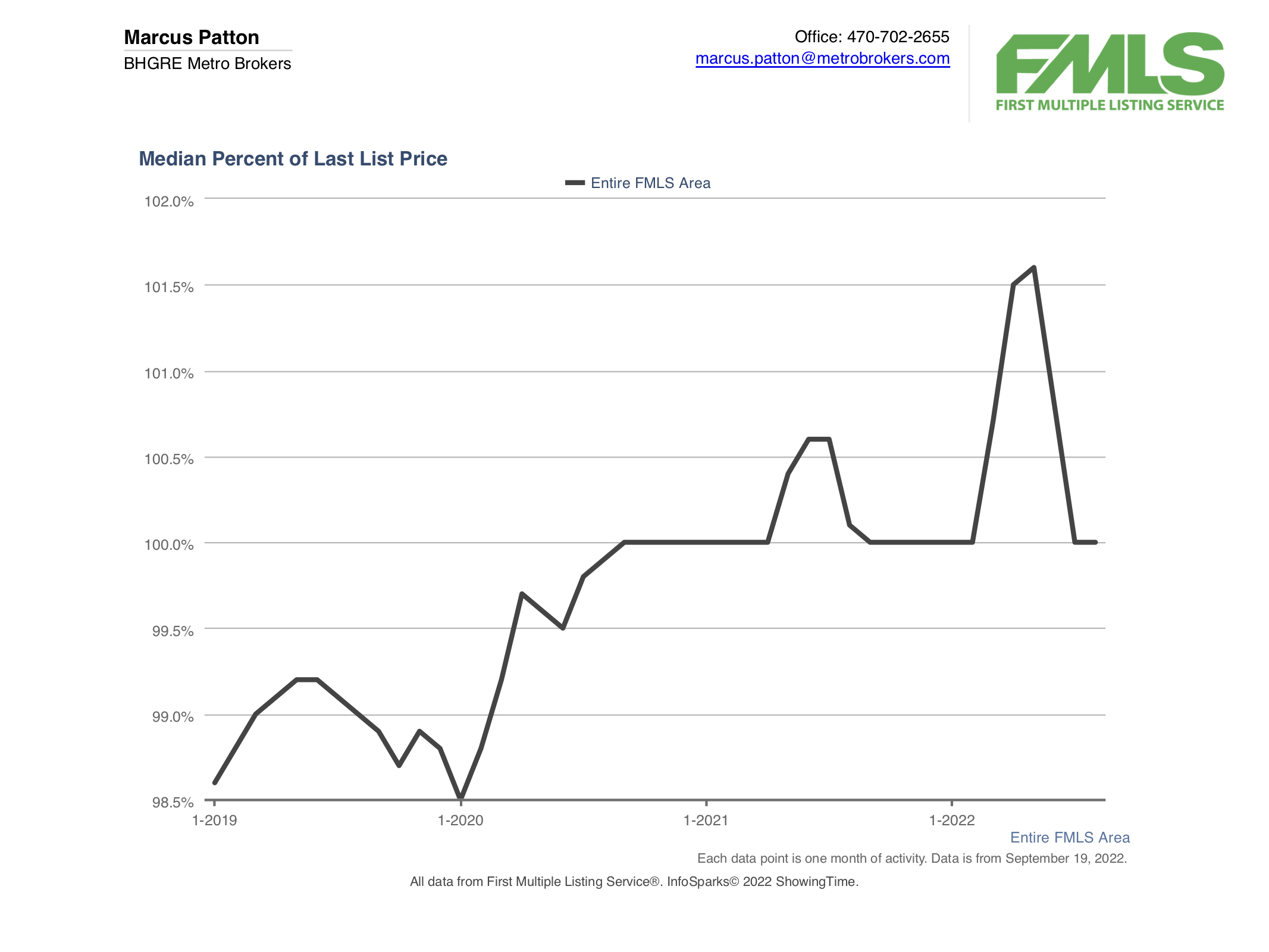

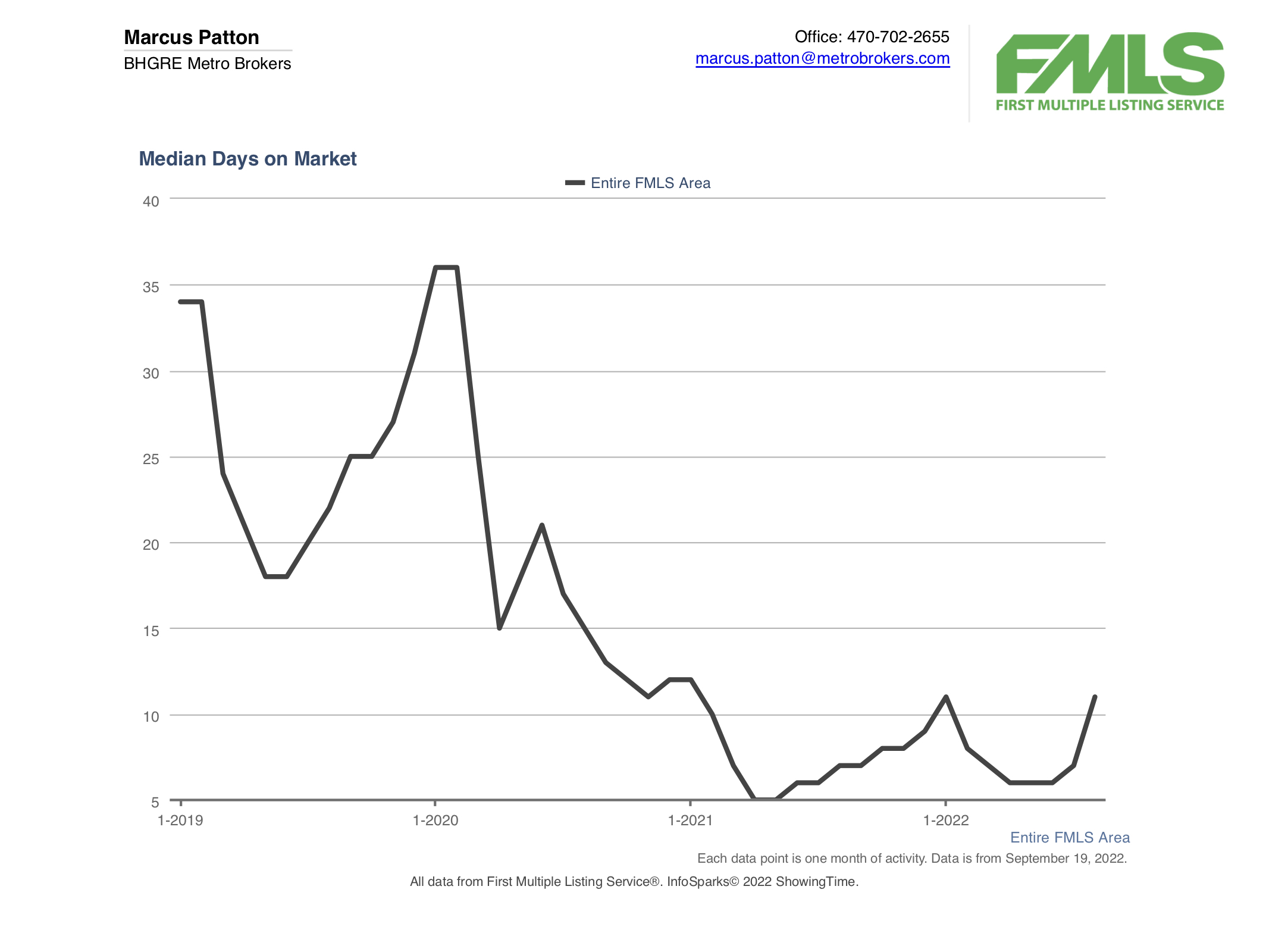

In September of 2019, before anyone in the U.S. had ever heard of COVID-19, there were 27,401 homes for sale in metro Atlanta, with 3.4 months of supply. The median sales price was $250,150, which represented 98.9% of listing price. Homes were on the market a median of 25 days before they went under contract.

COVID-19

March of 2020 saw the first closures of schools and offices due to COVID-19. Suddenly hand sanitizer was nearly impossible to find on store shelves, as well as (for some reason) toilet paper. No one knew exactly how this scary new virus was transmitted, and both buyers and sellers became skittish about strangers walking around touching things in private homes. But Georgia was luckier than some other states. Real estate was considered an essential business and allowed to continue to operate. Difficulties can spur innovation. Brokerages that were willing to persevere and exercise creative problem-solving managed to thrive even as others shut their doors to wait out the crisis. Virtual tours became commonplace, and programs became available that would allow sellers to move before making their homes available for showings. Overall, after a slight dip, the real estate market remained strong.

Rising prices and decreasing numbers of homes

In April 2020, months of supply stood at 2.9, with 23,618 homes for sale at a median price of $269,900, with sales at 99.7% of listing price. But days on the market had dropped to 15. Many buyers were less inclined to take time to look at lots of homes before making a decision. Sellers were more inclined to accept early offers and get the process over with quickly.

As the pandemic year progressed into 2021 and churned its way towards the summer of 2022, median home prices climbed steadily. By December 2020, they hit $290,000. By June 2021, the number was $341,000. In June 2022 the median price of homes in metro Atlanta reached $400,000.

The number of homes for sale declined from April 2020 to March 2021 by more than half to 9,882, rebounded slightly, then hit a new low of 9,866 in February of 2022.

Competition for homes heats up

Buyers have been in bidding wars for good properties. While it was once typical for sellers to list high on the assumption that they would end up negotiating a lower price to make a deal, now many buyers found that the only way they could get an offer accepted was to pay more. Sales prices reached 100% of listing prices in September 2020, and eventually peaked at 101.6% in May 2022. While 1.6% above listing price does not sound like much, remember that given the high price of homes, this difference can amount to many thousands of dollars.

Days on the market diminished rapidly from 21 in June 2020 to 5 days in April 2021. This number rebounded slightly last winter, but as of June 2022, it stood at 6. Of course, for sellers who are getting high prices, putting up with the inconvenience of the listing period – keeping their house spic and span, and vacating it at random hours for showings – means the shorter the days on the market the better. But in a more balanced market, it takes greater exposure to generate an offer at fair market value. The kind of frenzied bidding wars we have seen lately is a symptom of a serious imbalance between supply and demand, and the effect has left many homebuyers feeling outmatched by a system that seems unfair.

Unfair or not, and serious problems notwithstanding, the real estate market in metro Atlanta is certainly robust, and appears on track to remain so for some time to come. Our population is on the rise, and many of those moving here come from metropolitan areas where median prices are significantly higher.

But there are some signs that trends are changing, and some balance is returning to the real estate market.

Where we are today …

As of August, 2022, the median sales price stands at $380,000, down $20,000 since June. Buyers are paying a median of 100% of the listing price, also a decrease from recent months. Number of days on the market is on the rise, and has bounded back up to 11. The number of homes for sale has increased steadily for most of this year, reaching 18,081 in August. After a low of 1.1 as recently as January 2022, months of supply hit 2.1 in August 2022.

Does this mean all our problems in the metro Atlanta real estate market are behind us? Probably not. And even if we are at the beginning of a long period of real estate bliss and prosperity, good times bring challenges as well. Those of us who work in this field and who are in it for the long haul love the changes, and the opportunities to transform problems into creative solutions for our clients and customers.

– Marcus Patton

______

* Numbers and graphs are courtesy of First Multiple Listing Service.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link